Feb 23, 2018

Thirty-eight of the largest banking institutions in the United States will be subject to the Federal Reserve’s 2018 Comprehensive Capital Analysis and Review (CCAR) – up from 34 in 2017. Additionally, all banks with more than $10 billion in assets will be subject to the Dodd-Frank Act Stress Test (DFAST). CCAR and DFAST utilize the same three economic scenarios for stress testing, however, CCAR banks must also submit a plan for how they will utilize capital under each scenario.

As in past years, there are three scenarios – Base, Adverse and Severely Adverse – and they utilize the same 16 economic factors. These factors (e.g. GDP growth, unemployment, inflation, treasury yields, etc.) are the inputs for banks to simulate the economy.

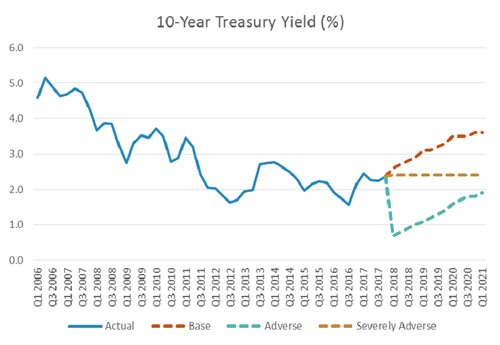

When looking at interest rates in the macro scenarios, both the Adverse and Severely Adverse scenarios drop the front-end of the yield curve. Below is a chart of the 10-year treasury yield for each scenario. By keeping the 10-year rate level with current rates and short-term rates at 0.1% for all time periods, the Severely Adverse scenario results in a significant steepening of the curve, whereas the Adverse scenario is more akin to a parallel shift down.

Under the harshest scenario, banks must evaluate how they will manage their balance sheets with 10% unemployment, equity markets down 65%, a steeper yield curve and wider credit spreads. From the perspective of growth, the Base scenario assumes nominal GDP will be above 4% every quarter whereas the Adverse and Severely Adverse have a mild and severe recession respectively.

In past years, the Fed has focused the macro scenarios on various risk factors in the economy. For example, in 2016 banks had to model negative interest rates. Given the recent market concerns over inflation, it is interesting that inflation is highest in the Base scenario with an average rate of 2.2%. However, inflation averages a little below 2% over the entire analysis period in the other two scenarios, reaching a low point of 0.9% near the beginning of the Severely Adverse scenario. Clearly the Fed is less concerned about the impact of inflation on banks and more concerned about unemployment, credit spreads and the yield curve. Regardless of the Fed’s focus, we know that banks will be busy over the next several months as they prepare their stress tests.

As of this writing in early February 2018, increasing inflation expectations have dominated recent market performance. A strong jobs report signaled an uptick in wages and GDP growth continued for the 16th consecutive quarter. Additionally, the recently passed tax overhaul has some investors concerned about future budget deficits and that this fiscal stimulus will add to inflationary pressures. Volatility has also returned to the markets with swings over 1000 points in the Dow and a 10-year treasury rate at 2.84%, its highest level in four years. With the stress tests requiring a simulation for Q1 2018, banks will have to determine the value of incorporating current market conditions into the Fed scenarios.

At

Newport Group, we have over 65 professionals that are dedicated to

BOLI and banking clients. This resource depth allows us to assist banks with stress testing their BOLI program. Whether a bank is subject to CCAR, DFAST or simply wants a better understanding of how their balance sheet will respond to different interest rate scenarios, Newport Group has the expertise, systems and process to add value to any BOLI program.

To download a copy of this article click here.